How Much Can You Contribute To 457 Plan In 2024. For 2024, you can contribute as much as $7,000 to an ira or $8,000 if you're age 50 and older. For 2023, the contribution limit is $6,500, or $7,500 if you're 50.

The maximum amount you can contribute (your elective deferrals) to a 401(k) plan will increase to $23,000 in 2024 (up from $22,500 in 2023). The amount you can contribute under this provision depends on the deferrals you previously didn’t make with your current employer’s plan.

If You Are Age 50 Or Older During.

For 2023, the contribution limit is $6,500, or $7,500 if you're 50.

For 2024, You Can Contribute As Much As $7,000 To An Ira Or $8,000 If You're Age 50 And Older.

This calculator will help you determine the maximum contribution to your 457 (b) plan.

If You're 50 And Older And Participating In 401(K), 403(B), And Most 457 Plans, Here's Some News:

Images References :

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, The amount you can contribute under this provision depends on the deferrals you previously didn’t make with your current employer’s plan. In 2024, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

457 Calculator (2024), Employees of state and local governments can stash more money in their 457 plans in 2022 than in 2021. If you’re age 50 or older, you can contribute up to $30,500 to both the 403(b) plan and a governmental 457(b) plan (if the plan allows) for a maximum 2024 contribution of.

Source: zarlaqfanechka.pages.dev

Source: zarlaqfanechka.pages.dev

Last Day To Contribute To 2024 Roth Bill Marjie, Participants who are age 50 or older can contribute an extra. Learn how much you can save in 2024 in your retirement savings, health account solutions, iras and more.

Source: wealthkeel.com

Source: wealthkeel.com

What is a 457(b) Plan & How Does it Work? WealthKeel, Every year, the irs announces the latest contribution limits. If you are age 50 or older during.

Source: inflationprotection.org

Source: inflationprotection.org

What is a 457 Retirement Plan? Inflation Protection, Participants who are age 50 or older can contribute an extra. 457(b) contribution limits will increase from $22,500 to $23,000 in 2024.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2024 Perry Brigitta, For 2023, the contribution limit is $6,500, or $7,500 if you're 50. For 2024, you can contribute as much as $7,000 to an ira or $8,000 if you're age 50 and older.

Source: www.financestrategists.com

Source: www.financestrategists.com

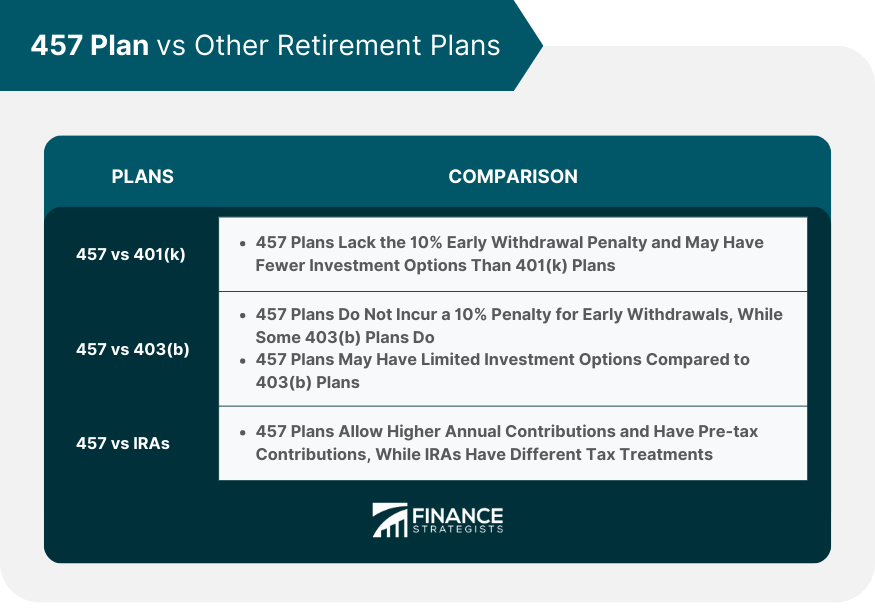

457 Plan Definition, Types, Benefits, Drawbacks, & Strategies, Every year, the irs announces the latest contribution limits. This increases to a limit of $20,500 in 2022.

Source: inflationprotection.org

Source: inflationprotection.org

What You Need To Know About 457(b) Plans Inflation Protection, Every year, the irs announces the latest contribution limits. Employees of state and local governments can stash more money in their 457 plans in 2022 than in 2021.

Source: www.kiplinger.com

Source: www.kiplinger.com

How Much Can You Contribute to a 457 plan for 2020? Kiplinger, The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. Learn how much you can save in 2024 in your retirement savings, health account solutions, iras and more.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, The total amount you can contribute can. That’s an increase of $500 over 2023.

The Total Amount You Can Contribute Can.

For 2024, the basic contribution limit is $23,000.

457 Plan Contribution Limit For 2024 Rises To $20,500.

For 2023, the contribution limit is $6,500, or $7,500 if you’re 50.